Easy Loans Ontario: Simplified Approaches to Financial Backing

Easy Loans Ontario: Simplified Approaches to Financial Backing

Blog Article

Unlock Your Financial Possible With Convenient Loan Services You Can Count On

In the world of personal financing, the availability of hassle-free lending solutions can be a game-changer for individuals aiming to open their financial capacity. When looking for economic aid, the integrity and dependability of the finance company are paramount factors to consider. A myriad of car loan options exist, each with its own collection of considerations and benefits. Comprehending just how to browse this landscape can make a significant distinction in attaining your monetary goals. As we check out the realm of hassle-free fundings and trusted services even more, we reveal vital understandings that can equip individuals to make educated decisions and safeguard a steady economic future.

Advantages of Hassle-Free Loans

Easy loans offer borrowers a streamlined and effective way to access financial support without unneeded issues or hold-ups. In contrast, hassle-free car loans prioritize rate and comfort, offering consumers with quick access to the cash they need.

Moreover, easy financings commonly have marginal eligibility requirements, making them accessible to a more comprehensive range of individuals. Traditional loan providers often call for comprehensive documents, high credit history, or collateral, which can omit lots of possible customers. Hassle-free lendings, on the various other hand, concentrate on price and versatility, offering aid to people that might not fulfill the rigid requirements of standard banks.

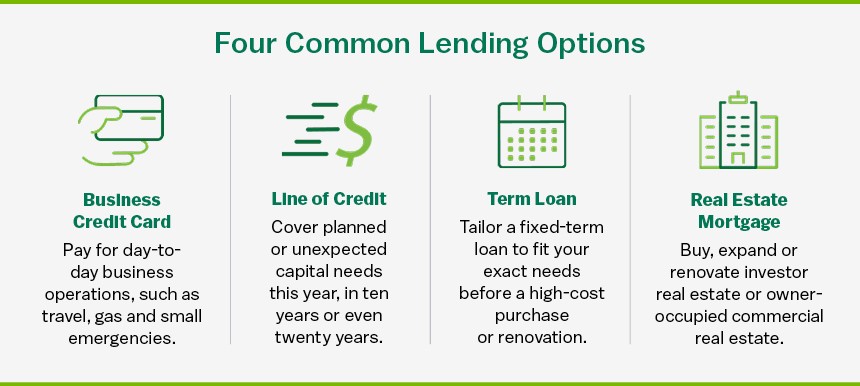

Sorts Of Trustworthy Car Loan Provider

Exactly How to Receive a Financing

Exploring the vital eligibility standards is important for individuals looking for to get a car loan in today's economic landscape. Lenders generally analyze a number of factors when identifying a debtor's qualification for a car loan. Among the main factors to consider is the candidate's credit report rating. An excellent credit history score indicates a history of accountable financial habits, making the consumer less risky in the eyes of the loan provider. Earnings and employment status additionally play a considerable duty in the loan approval procedure (loan ontario). Lenders require assurance that the borrower has a steady revenue to repay the finance in a timely manner. Furthermore, the debt-to-income proportion is an essential statistics that lending institutions use to examine an individual's ability to manage extra debt. Offering up-to-date and exact economic details, such as tax obligation returns and financial institution declarations, is important when making an application for a lending. By comprehending and satisfying these qualification requirements, individuals can enhance their opportunities of receiving a funding and accessing the monetary support they require.

Handling Loan Payments Intelligently

When borrowers efficiently secure a car loan by fulfilling the essential eligibility criteria, sensible management of financing repayments ends up being extremely important for maintaining financial stability and credit reliability. Timely payment is crucial to avoid late costs, penalties, and adverse influence on credit rating. To manage finance settlements wisely, borrowers need to create a budget that includes the monthly payment quantity. Establishing automatic payments can assist guarantee that repayments are made in a timely manner each month. In addition, it's advisable to focus on financing settlements to stay clear of falling behind. In situations of financial difficulties, connecting with the lender proactively can occasionally cause alternate repayment setups. Checking debt records regularly can also assist borrowers remain informed regarding their credit scores standing and recognize any discrepancies that might require to be dealt with. personal loans ontario By handling finance repayments sensibly, customers can not only fulfill their financial commitments but additionally construct a positive credit rating background that can profit them in future monetary undertakings.

Tips for Choosing the Right Funding Option

Choosing the most ideal financing alternative involves complete research and factor to consider of private economic needs and situations. To start, examine your monetary circumstance, consisting of revenue, expenses, credit history, and existing financial obligations. Recognizing these variables will certainly assist you establish the kind and amount of car loan you can afford. Next, compare financing options from various lenders, consisting of typical financial institutions, cooperative credit union, and online lenders, to discover the ideal terms and interest prices. Consider the financing's overall cost, payment terms, and any type of additional charges connected with the funding.

Furthermore, it's crucial to choose a funding that aligns with your monetary objectives. By following these ideas, you can confidently pick the ideal finance option that aids you accomplish your economic goals.

Conclusion

In verdict, opening your financial potential with convenient funding solutions that you can trust is a accountable and wise decision. By comprehending the advantages of these financings, recognizing exactly how to qualify for them, handling payments intelligently, and choosing the ideal lending choice, you can achieve your economic objectives with self-confidence and assurance. Trustworthy loan services can provide the assistance you require to take control of your funds and reach your preferred outcomes.

Secured car loans, such as home equity loans or cars and truck title car loans, permit debtors to utilize collateral to secure reduced passion prices, making them an ideal choice for people with beneficial properties.When customers successfully secure a loan by fulfilling the essential qualification requirements, sensible administration of funding payments becomes vital for preserving economic stability and creditworthiness. By handling loan settlements properly, consumers can not just accomplish their economic obligations however also build a favorable credit background that can benefit them in future monetary endeavors.

Consider the lending's complete expense, repayment terms, and any type of additional charges connected with the car loan.

Report this page